Credit period

The credit period indicates the period between the time when you send an invoice or receive a bill until the money is actually paid. The indication of a credit period (days) is one of the things, you must consider in budget123 if you are going to work with cash budgets.

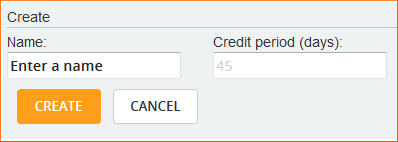

You will find the credit period setting by clicking on an account name or in the Chart of Accounts.

During the credit period, budget123 automatically places the amount on the system accounts for calculated payables and receivables respectively.

These were selected during the system configuration. You will find them in Global Settings >>

System Accounts.

How the credit period is calculated in budget123

budget123 calculates the credit period as follows: In budget123 all months have 30 days. If, for example, you budget for 100K kr. in turnover in January, the amount is divided into 30 equal parts (1/30 for each day). With a credit period of, say, 15 days, the system reckons that 15/30 parts are invoiced before January 16, and the payment is expected in January. The other 15/30 parts are said to be invoiced after January 15, and are expected to be paid in February.

Examples of different credit days

Here are a few examples of how the cash flow will be affected by different credit periods for a turnover of 100K kr. in January (VAT is not included in these examples).

| All months have 30 days |

| |

January

|

February

|

March

|

| Turnover |

100,000 |

|

|

|

| Credit days |

0 |

|

|

| Cash flow |

100,000 |

|

|

|

| Credit days |

15 |

|

|

| Cash flow |

50,000 |

50,000 |

|

|

| Credit days |

30 |

|

|

| Cash flow |

0 |

100,000 |

|

|

| Credit days |

45 |

|

|

| Cash flow |

0 |

50,000 |

50,000 |

|